features

IHRSA update: Membership patterns

A new IHRSA report examines health club consumer behaviour. We take a look at the key findings

In September, IHRSA released The 2016 IHRSA Health Club Consumer Report, produced by consultancy firm ClubIntel. This annual publication, based on a nationwide sample of more than 32,000 interviews, provides demographics and health, sports and fitness participation data on American health club consumers (defined as people who have used a health and fitness club within the last 12 months).

While the data comes from the United States, many aspects of the 108-page report have global relevance.

We outline some key insights derived from the member behaviour patterns observed in the study.

Length of commitment

Roughly 72 per cent of consumers see membership as a five-year commitment, at least until they reach the age of 55 – at which point levels of commitment rise.

However, younger adults – and especially those under the age of 25 years – are more likely to see the purchase of gym membership as a short-term transactional experience (an average of 2.9 years among those aged 18–24).

Those aged 25–34 average 3.6 years of membership; those aged 35–44 notch up 4.9 years; and the 45–54 age group comes in at 5.4 years.

People aged 55+ tend to see membership as an even longer-term investment: the Baby Boomers average over seven years of membership. They’re more likely to commit to long-term membership for health-related outcomes, including active ageing, weight loss or post-rehab from injury, as well as to cultivate relationships at the club.

Keeping members longer

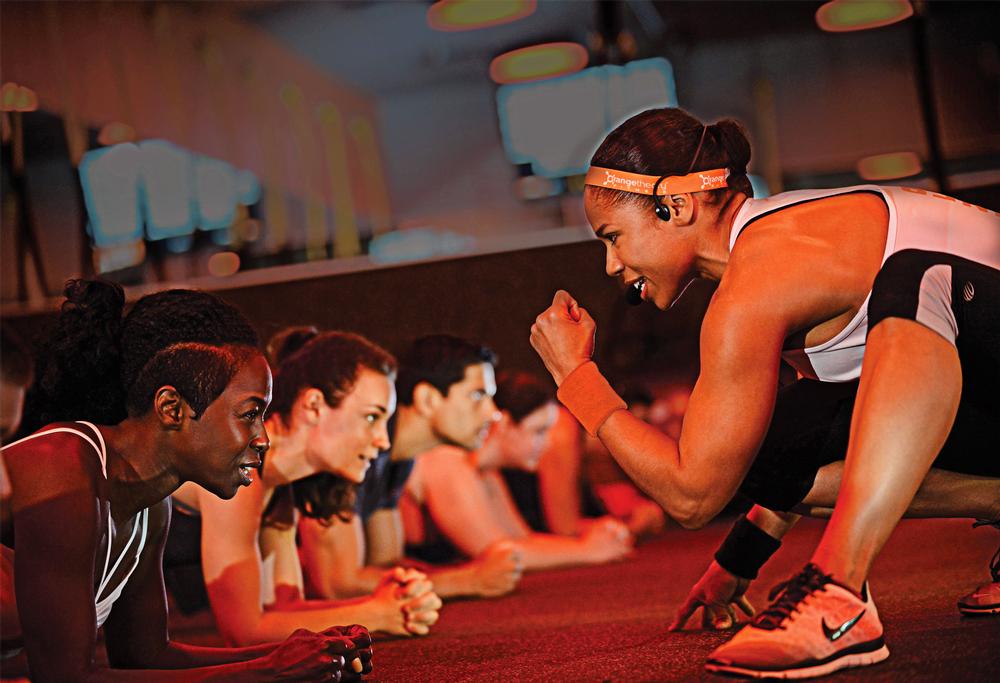

However, the data does indicate an opportunity to develop a longer tenured membership base among younger adults. Millennials might be encouraged to stay for an extra one or two years if clubs were able to mirror some of the inspiration, novelty and programming present in the boutique studios.

Indeed, the average age of a boutique user is nearly a decade younger than the user profile at traditional clubs. If we look to boutiques, we might see the trigger for improved tenure.

Having longer tenured members has bottom-line implications for the growth of the industry. First, these members use their clubs more frequently, which has implications for subscriptions growth, incremental revenue growth, referrals and operating profit.

The most powerful association between membership tenure and membership usage is among individuals who have held their membership for at least six years. Members in this segment use the facility at least once a month more than those whose tenure is less than six years – and in some instances, once a week more often.

Secondly, these members of six years and over tend to have higher household earnings – a critical element in driving future ancillary revenues. The percentage of highly tenured health club members who have high household incomes (over US$100,000) is notably higher than the percentage of those who come from lower income groups.

Meanwhile, members staying for two to five years are equally likely to make very little money or make a lot of money – the data shows no correlation.

Unless the industry identifies a way to significantly boost membership tenure, it will lose out on one of the most profitable segments of the business.

Attendance levels

Over the past few years, average attendance levels among members have held steady at roughly two visits a week – it has hovered consistently between 101 and 103 visits annually.

The question facing our industry is whether this is sufficient to solidify the ‘fitness habit’. The data clearly shows that activity levels are considerably higher among more long-standing members, leading one to ponder whether higher levels of usage drive tenure – and if so, whether that’s due to the formation of relationships over time or the achievement of goals.

Activities of choice

Although usage of traditional pieces of fitness equipment has declined in recent years, equipment remains the top attraction at health clubs. Treadmills, resistance/selectorised machines and free weights are still the top three forms of exercise at health clubs.

However, many non-equipment-based training activities have seen a growth in usage in recent years. Activities such as cross-training, bootcamp, calisthenics, barre, dance and related choreographic movement classes have made inroads into the lexicon and preferences of health club members.

Generation and gender

There are striking differences in the preferences of men and women, as well as between the generations in the types of activities they pursue.

In the case of the genders, the differences are dramatic, and represent an opportunity to explore new approaches to positioning and branding facilities. The activities that skew most heavily towards women are pilates, dance, step and other choreography classes, yoga and group cycling. For men, it’s squash/racquetball/tennis, free weights and resistance machines.

There are also differences between the various generations. Those aged 18–34 are a leading force in the growth of fitness studios. These younger consumers want to engage in specific training formats – specifically group training including yoga and cross-training programmes. They also expect a strong online presence.

Meanwhile, people over the age of 55 are more inclined to engage in tai chi and aquatic exercise, and look for stellar in-person customer service and ongoing interactions with club staff.

There’s an opportunity here for health and fitness facility operators to create more targeted activities and business models to cater for the likes and needs of different genders and generations. Success in the future is likely to depend on a more niche- and tribal-driven focus than in the past.

About IHRSA

Founded in 1981, IHRSA – the International Health, Racquet & Sportsclub Association – is the only global trade association, representing more than 10,000 health and fitness facilities and suppliers worldwide. Locate an IHRSA club at www.healthclubs.com

To learn how IHRSA can help your business thrive, visit www.ihrsa.org

Obtain the report

The 2016 IHRSA Health Club Consumer Report is available for download at ihrsa.org/consumer-report for US$99.95 (IHRSA members) or US$199.95 (non-members). Questions may be directed to [email protected]