features

Insight: The shape of now

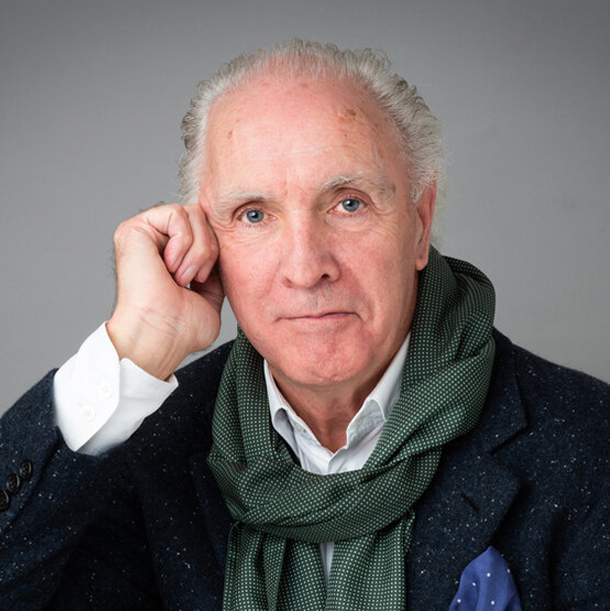

More members and record market value, Leisure DB’s David Minton discusses this year’s State of the UK Fitness Industry Report

The UK has slightly fewer gyms (0.9 per cent) in 2023 than in 2022, but member numbers are up 3.9 per cent and market value is the highest we’ve observed. These are some of the key findings from our State of the UK Fitness Industry Report 2023.

The increases in member numbers and market value were greater in the private sector than in the public sector, with budget chains, PureGym and The Gym Group, the two leading operators in terms of new gym openings in the 12 months to the end of March 2023.

The average price of a gym membership currently stands at £44.92 – but there are regional differences. The costliest memberships are in London at £69.81 per month (55 per cent above the UK average), and the most affordable in Yorkshire and Humber at £35.52 per month (21 per cent below the UK average).

The UK’s top 10 public sector operators account for just under 30 per cent of all public gyms and almost 40 per cent of both public sector members and public sector market value, while the UK’s top 10 private sector operators account for 30 per cent of all private clubs, but more than 60 per cent of private sector members and almost 60 per cent of private sector market value

This year marks the 15th edition of the report to be published for the UK’s fitness sector since 2007 and the figures make for particularly fascinating reading, as a newly-honed fitness sector emerges from the pandemic, leaner yet arguably stronger and more resilient.

Although the devil’s in the detail, I’d suggest that the pandemic, inflation and higher energy costs will – in the long term – be beneficial for the industry.

Positive impact of the pandemic

First, the pandemic removed so-called ‘sleepers’ – something I personally believe is a long-term embarrassment for the sector and an issue that has been a fly in the ointment of all we stand for. After all, how can people achieve results and improve their health if they never visit our facilities or benefit from our support?

Second, every indication is that ‘health is the new wealth’, and those who remain customers of our health clubs have been encouraged to place a greater value on our products and services and to use them more.

These are all positive signs of the sector’s long-term resilience and they highlight a customer-centric opportunity to play a more proactive role in preventative healthcare.

Third, higher costs have legitimised monthly price rises. Over the 12 months to the end of March 2023, a cumulative increase in monthly fees raised the value of the UK industry to new heights – all without impacting member numbers. This is notable, as our sector has for many years been slow to keep up with inflation and price indices: in real terms, the cost of our products and services have fallen significantly over time. Now, buoyed by the dual forces of higher costs and higher perceived value, we’re building back up to where we need to be.

At IHRSA San Diego in March, speaker after speaker talked about how they had been forced to raise prices, only to discover it did not have an impact on member numbers. Have we been undervaluing our product? Have we not appreciated the scope to participate at different price points? Have we failed to understand the latent demand?

No wonder the arts received a £1.5bn pandemic recovery fund in the UK, compared to £100m for sports and fitness. The arts – more advanced on customer insight – could provide answers to the government’s questions, drawing on data from over 800 organisations which between them represent around 220,000 jobs.

The sports and fitness sectors couldn’t provide enough answers – cue far less support and a heavier administrative burden attached to the support that was provided.

This must change and next time the government asks questions, our industry must be ready to answer them.

Through events such as our annual Evolve conference and new Leisure DB Roundtables, we’re working in collaboration with suppliers and operators across the industry to spearhead collaboration, communication and change within the industry.

Higher prices, added value

But I digress. Let’s return to the price rises, for they’re significant enough to be changing the face of the market. We’re seeing low-cost brands move into the mid-market, mid-market brands into premium. It’s a trend that’s seen some brands move out of the low-cost bracket altogether, leading this market segment to shrink for the first time since it emerged in 2011.

We’re also seeing a new category emerging that I call ‘super-premium’. Commanding membership fees of upwards from £150 a month, in London the most expensive is £606 a month.

With these price increases come value-added extras from most brands; many are reaching into the booming field of wellness, focusing on understanding and improving holistic personal health. This increasingly individual and personalised approach will no doubt generate some compelling human interest stories, and we plan to weave these into future annual reports.

Of note, feedback we’ve been getting at events such as IHRSA and FIBO is that many health club brands across multiple countries have also raised their fees and increased overall market value through a similar cumulative effect to the UK. This is, however, difficult to confirm without audit methodology comparable to the UK – something that doesn’t yet exist.

A personal footnote

I have a dream where everyone working or involved in our sector understands the size and scale of the UK industry, so for this first year we’re targeting 100,000 global downloads of our new free report summary – called Spotlight. I also hope it helps break down some of the isolation that exists across the sector.

Get your copy at www.leisuredb.com/publications.

The full State of the UK Fitness Industry Report 2023 can be purchased at www.leisuredb.com/publications with 15 per cent off the purchase price for HCM readers using promo code HCM15 until 31 July.

3.9% Increase in members

0.9% Fall in number of clubs

11.5% Increase in market value

15.1% Penetration rate

As many HCM readers will be aware, the State of the UK Fitness Industry Report 2023 was launched at the Evolve conference in London on 7 June.

Evolve was a movement I initiated in 2021, conceived not just as an annual conference but as a year-round movement, catalyst and platform for conversation, collaboration and change within the UK health and fitness industry.

Bringing together industry disruptors and thought leaders and leveraging Leisure DB’s data and insights, Evolve aims to inspire new thinking, encourage diversification into untapped markets and stimulate sector growth.

It’s a collaborative space where industry stakeholders can come together, share insights and collectively inspire change. Joining the Evolve movement means actively participating in shaping the future of the fitness and leisure sector. By addressing the ‘state of the industry’ together, we can explore innovative solutions and new opportunities to accelerate growth.

At the heart of Evolve is the fundamental question: How do we evolve the human experience? This overarching theme guides our discussions and actions as we seek to address the state of the industry and inspire collective change, with this year’s conference exploring ways we can continue to meet consumers’ changing needs and expectations as we prepare to move into a post-pandemic world.

At this year’s event, Andy King, CEO of MCR Active, shared his manifesto for change and spoke passionately about the need to align the sector with the Office of Health Inequality and Disparities (OHID) rather than the DCMS. Jenny Patrickson, MD of Active IQ, discussed the need to constantly update the training curriculum to successfully support and deliver more diversified offerings. Barclays’ Mike Saul provided a holistic, helicopter view of the fitness sector post-trauma. I shared an overview of the State of the UK Fitness Industry Report 2023 and Keith Smith advocated the evolution of the human experience on the gym floor, harnessing empathy and passion to build emotional significance and ensure we’re a priority in people’s lives.

Those unable to attend the conference in person or via the live stream can download a 12-page document – Evolve 2023: The review – which provides key takeaways from each of the day’s speakers. Alternatively, the whole day was recorded and is now available to view online. We’ve made both of these resources available to everyone, with our compliments, via our website: www.leisuredb.com

My thanks also goes to David Turner, Leisure DB chair, who at the event expressed how everything we do at Leisure DB is ‘for the industry, by the industry’. Our team may be small, but we have a combined 200 years in the sector, and our passion remains as strong as ever, championing the need to harness data to propel the sector into a new era of success.