features

Member payments: Money matters

What’s the future of member payments? Technology is moving fast, but is it helping operators to make more money? Kath Hudson asks the experts

According to research from payment service Judo, one in five consumers failed to make a purchase in a shop in the last six months because the retailer didn’t take cards. Some 70 per cent of consumers prefer to pay by card, while 60 per cent say they would spend more with a business that takes cards than one that doesn’t.

There’s a perception among small businesses in particular that card transactions are too expensive to process, or simply not as convenient as cash. However, that need no longer be an issue thanks to innovative products from companies such as Swedish firm iZettle, whose new service allows anyone to carry out a card transaction on their smartphone or tablet. Two devices are offered which can plug into, or wirelessly connect to, the smartphone. One accepts a PIN (and costs £99), while the other takes signatures (£20). Both come with an app installed onto the phone or tablet. iZettle takes 2.75 per cent commission on each transaction. Analytics are available to keep track of payments, revenue and returning customers, which will show if the system is washing its face.

Or is cashless and cardless the way to go – if members could pay via their phone, for example, would this make them more inclined to have an impulsive coffee, or buy a new swimsuit while the endorphins are flowing?

In general, are clubs keeping up with consumer trends? What new technology is coming on-stream that could help operators offer a more convenient service, removing barriers to customers spending money and thereby boosting secondary revenue? We ask the experts.

TOM WITHERS,

HEAD OF SALES,

GLADSTONE

Removing the barriers that prevent customers from spending money, including the need for cash or card, is essential to increase secondary spend in clubs.

Cashless systems have been around for over 20 years and are a tried and tested method in adjacent industries such as golf. Paying onto an account is the simplest way to offer this. However, the fitness industry uptake of this technology has, so far, remained in high-end, private sector clubs.

The way we’re heading is towards continuous authority payments, similar to how Amazon and iTunes work. The member sets up an account linked to a payment card and can spend by entering a password. It’s easy for the consumer and secure for operators, as card details are held off-site by secure bureau services, avoiding PCI complications.

Payment service providers like PayPal are launching new technology this year that will allow people to pay by swiping their phones, using this continuous authority service. Barclaycard already issues “Wave and Pay” stickers for phones, which allow them to be swiped for low-level transactions. It’s an acknowledgement by card companies that, while people might not always have their wallets, they invariably carry their phone with them.

Continuous authority will supersede the other cashless models, as it breaks down all the barriers for purchasing and increases spend. How often do you put a few more items than you intended in your basket when shopping on Amazon?

ANDRES MORAN,

DIRECTOR OF BUSINESS DEVELOPMENT,

MINDBODY

MINDBODY introduced the Express app in May this year, which takes all the daily tasks needed to run a health club and makes them mobile, including adding new clients, getting them to sign waiver forms and checking them into classes.

The most popular function of our new app is the ability to swipe a credit card straight from your mobile device to take a payment. It makes the customer experience more about the interaction and less about the front desk. Imagine not having a front desk at all – that’s now becoming a possibility.

Empowering clients to manage their own experience by giving them access to their account, class schedules, bookings and registrations satisfies their need to get things done on their own schedule, while simultaneously reducing the front desk overhead.

From a convenience standpoint, cashless clubs are a good idea: nobody likes lugging their wallets around if they don’t have to. It also provides a layer of physical security to your business: no wallet, no possibility of theft.

Technology does help clubs make more money if it supports client retention and acquisition and can cut down overheads. It also provides businesses with competitive intelligence: customer behaviour is always changing, but it’s changing even faster with the speed of technological disruption happening around us on a daily basis.

Mobile technology gives the business the feeling of being innovative, which engages and retains consumers: who doesn’t love going to the Apple Store?

SEAN MAGUIRE,

FOUNDER AND MD,

LEGEND

The fitness industry is traditionally slow to adapt to new technologies as consumers habits change. Going forward, we can expect to see more use of smartphones and faster credit/debit card transactions, such as near field.

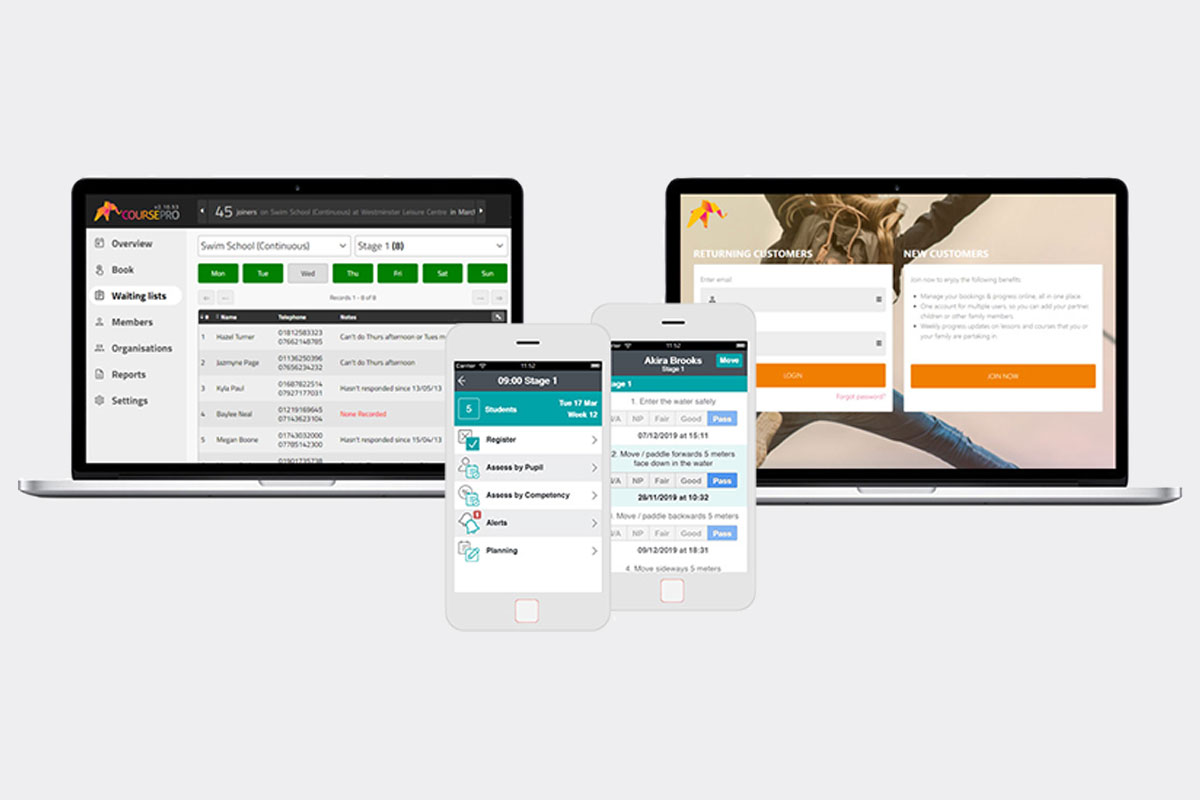

Self-service is also a growing trend, with people taking care of their own membership, bookings and purchases online from a PC, kiosk, smartphone or tablet. Going forward there is likely to be more flexibility, allowing members to flit from method to method.

As new technologies enter the mainstream, self-service will become even more prevalent, making it easier for people to pay how they want, when they want, and to make use of multiple channels – such as direct debit and credit card – simultaneously.

Cashless clubs are a good idea, but if it’s the only way to pay it’s bound to have a negative impact on sales potential, as not everyone would be prepared to pay money to the club before making a purchase. Cashless as an additional offering boosts sales by making it easier to pay. However, if you offer credit, expect problems collecting money.

IVAN STEVENSON,

DIRECTOR,

DEBIT FINANCE COLLECTIONS

Clubs are missing out on sales by not offering a cashless option, especially as the technology is now available to make this much easier. One report found that cashless systems can boost member spend by 25 per cent.

The further rollout of the Single European Payment Authority (SEPA – see HCM July 12, p59) will help chains which are expanding overseas, as it will offer one solution for direct debits across borders: operators will be able to collect memberships for a club in Spain, for example, at the same time as their UK operations.

Giving customers the chance to join online is showing great results in club profitability. It takes the admin burden away from clubs, and puts the consumer in charge. The clubs we work with can see an increase in year-on-year sales of between eight and 10 per cent, but one high-end club achieved a 23 per cent rise.

One of the main influences in the near future will be further leveraging of mobile phone technology, allowing people to join online, as well as paying in clubs using their phones.