features

Keeping afloat

Leisure centres are a mainstay of childhood memories; think swimming, talc and vending machines. But austerity measures have hit the sector hard – are the cracks beginning to show? Mike Hill and Professor Simon Shibli explore how the sector is performing

Public sector sport and leisure is a complex business with many stakeholders and multiple strategic and operational objectives. Nonetheless, Sport England’s National Benchmarking Service (NBS)* enables managers to make sense of this complexity, providing a clear picture of performance and how it’s changing at local and national levels. This comprehensive NBS data helps clients to set realistic priorities and targets.

Mind the gap

One of the most striking findings to come out of NBS studies in their 17 years is the difference between the top- and bottom-performing sites in terms of financial efficiency.

The evidence suggests that whilst top quartile centres typically make operating surpluses, bottom quartile centres still have subsidies equivalent to around a quarter or more of their operating costs. The difference between the 25 per cent and 75 per cent benchmarks is equivalent to £495,783 a year per centre – a gap that’s widened significantly since 2014.

However, with belts tightening further than ever it’s exciting to see a trend in rising efficiency that shows cost recovery rates increasing and subsidy levels decreasing across the board. Centres at the median (50 per cent) benchmark now show a one per cent surplus, compared with a deficit of nine per cent in 2014. At the 75 per cent benchmark, centres show a 123 per cent recovery rate (£272,807 surplus) – a significant improvement on 110 per cent (£93,528) in 2014.

This is despite throughput levels remaining unchanged, showing we’re not necessarily attracting more people but simply charging more for activities and not being overly concerned if those on direct debit make limited use of their membership. The relatively weak performers have much to learn from the better performers: another benefit of the NBS is that it facilitates managers learning from one another.

Whilst many differences in site performance are down to factors outside the operator’s control, such as the building’s age, lack of investment, energy inefficiency or the catchment area’s disposable income, some must be down to ‘controllables’, such as economies of scale, marketing, programming, pricing and general operational management.

These can make a significant difference, as Mark Crutchley, CEO of Circadian Trust in Gloucestershire, explains: “In 2010-11 we still received a substantial six figure management fee from our commissioning council. This year we start paying them a significant rental. It’s a turnaround well in excess of a million pounds per annum, in less than six years, as a result of many factors: increased efficiency, revising pricing structures and programme offering and improving quality.

“But, we’ve also invested considerably in facilities, technology, systems and training to improve our offer, so we’ve increased visitor and membership numbers and the range of activities; not just increased prices or slashed costs. However, our affluent area is key. It would’ve been far more difficult, perhaps impossible, in an area of low affluence and high deprivation or highly rural with a low population density.”

Embracing inclusivity

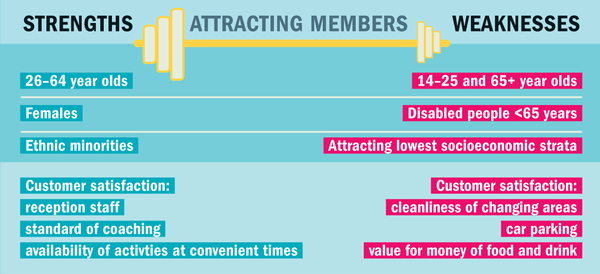

One area where the industry excels is attracting key target groups, particularly females and ethnic minorities, of whom they attract a higher proportion than actually live in the catchment area; so it’s clear a good job is being done in marketing, programming and pricing for these groups. As women typically have lower participation rates than men, public leisure centres should be applauded for countering the general pattern.

There is relative weakness in attracting people from the lowest socioeconomic groups, people <65 years old with a disability, 14-25 year olds and those aged 65+. Being in the lowest socioeconomic group is tough and characterised by multiple factors such as adverse health, housing, education and employment. If subsidy is truly being used to reach disadvantaged people, those in the lower socioeconomic groups must be prioritised.

Sound service

Does the onsite experience live up to expectations? The sector scores well for customer service satisfaction across the overall visit, reception, standard of coaching and availability of activities – positive findings for a ‘people’ industry where the product and service are paramount. But changing room cleanliness, car parking and value for money of food and drink consistently lag behind.

Cleanliness, especially changing areas, continues to appear near the bottom of satisfaction scores, yet is always near the top of importance rankings. With such a wide gap between importance and satisfaction, it’s the largest service quality problem identified by the NBS annually.

In contrast, value for money of food and drink scores low for satisfaction and also low in importance. This could explain why average secondary spend is just 15 pence per visit. As Theresa England, contract and partnerships manager with Bigwave Media, points out, given that food and drink is typically the main secondary income earner for NBS facilities, there’s work to be done: “According to Mintel, the F&B market within the leisure centre sector was £96m for the year to July 2016. This typically represents around 10 per cent of a facility’s turnover, yet it’s an area that’s frequently neglected.” (see Health Club Management September 2017)However, customer satisfaction with the basic service offer is strong, and has improved steadily over the years.

Who’s in charge?

The latest report shows a significant change in who’s managing the centres within the NBS sample, which may explain both improvements and deterioration in some indicators.

Sites managed by smaller, local trusts have halved compared to 2014 and the share of centres managed by external partners, which includes larger trusts and commercial contractors, has increased from 60 per cent to 79 per cent within the NBS sample.

The clearest finding is that external partners and local trusts continue to perform considerably more efficiently than in-house operations. However, we must remember that the NBS sample may not be wholly representative of the sector.

There’s also an argument that external partners tend to operate newer, more cost-efficient centres with a better mix of new facilities, compared to the older stock in-house operations are being left to run.

Nevertheless, external partners are the top performers for subsidy indicators and cost recovery, as well as total operating costs per visit, central establishment charges, secondary income per visit, fitness income and main hall income.

Local trusts appear to have better performance across maintenance and repair costs, staff costs as a percentage of total income, direct income and total income, and number of members per fitness station. Whereas in-house providers show efficiency strengths around energy costs, energy efficiency ratings, total swim income and swim lesson income.

On the defence

With austerity meaning local authorities continue to scrutinise their budgets, it’s vital operators defend their subsidies, which requires convincing evidence of access, utilisation and customer satisfaction. So despite the recent benchmarks showing improvements in some efficiency indicators, reducing subsidies and attracting the most deprived people in our communities remain key challenges.

*Sport England’s National Benchmarking Service (NBS) is based on 115 centres and more than 35,900 customers to provide a robust sample size, measuring performance standards for indoor sports and leisure centres with one or both of two core facilities: a four+ court sports hall and/or a 20m+ swimming pool.

Cleanliness continues to appear near the bottom of satisfaction scores, yet is always near the top of importance rankings

About the authors

Mike Hill, director of Leisure-net; Professor Simon Shibli, professor of Sport Management and director of the Sport Industry Research Centre (SIRC), Sheffield Hallam University, UK.

[email protected]

@_leisurenet

www.leisure-net.org